How to use the BTST Strategy scanner?

This scanner identifies stocks suitable for BTST (Buy Today, Sell Tomorrow) trading based on volumes, RSI, and historical prices.

Let’s learn about the indicators used in this scanner.

Volume

It refers to the total number of shares or contracts traded for a security during a given period. The volume is used to gauge the strength of a price movement; higher volume often indicates stronger, more reliable trends, while lower volume can suggest weaker trends or potential reversals. It helps in confirming price movements and market sentiment.

Relative Strength Index (RSI)

It is a momentum oscillator traders use to measure the speed and change of price movements. It ranges from 0 to 100, with values above 70 indicating overbought conditions and below 30 indicating oversold conditions. The RSI helps identify potential buy or sell signals and trend reversal based on market momentum.

This strategy is specifically designed for traders who wish to buy today and sell their trade tomorrow. It effectively signals when a stock is near its 52-week high and shows momentum from the previous day, allowing traders to capitalize on the move the following day.

To implement this strategy, we recommend using the following stock universe, indicators, and time frame:

- Stock Universe: Nifty 50

- Indicators: Volume, RSI

- Time Frame: Daily, 30-minute

Let’s learn how to enter & exit a trade with this strategy.

Entry

You can take a trade when all the below conditions are met:

1) Once a stock is shortlisted, check its chart at 3:00 p.m. on a 30-minute timeframe. Trade can be taken in the last 30 minutes.

2) The last candle should be closing near the day’s high.

3) Make sure that the daily RSI is above 65.

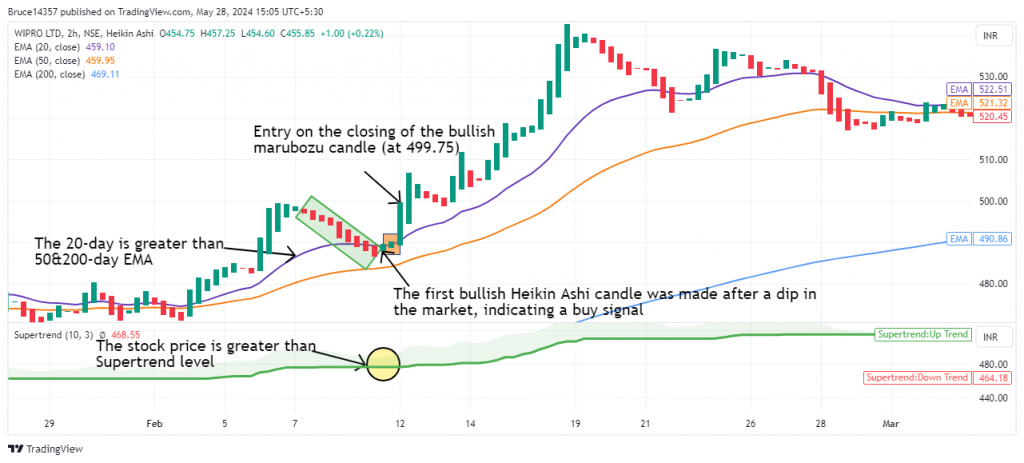

For a more risk-averse approach, consider entering the stock only when the bullish candle surpasses the high of the previous candle. Spotting a bullish candlestick pattern like a bullish marubozu or morning star provides strong confirmation for entering the trade.

The following chart marks the ideal entry points after the conditions of the strategy have been met:

Stop Loss

The low of the last candle acts as a stop loss.

Exit

You can exit the trade in either of the following instances:

1) A minimum risk-to-reward ratio of 1:2 should be in place.

2) Exit the stock in the first hour of opening, whenever the target or stop loss is achieved.

3) If the target or stop loss is not triggered, exit within 1 hour of closing.

Spotting a bearish candlestick pattern like a bearish marubozu, or evening star along with either of the above conditions provides strong confirmation for exiting the trade.

The following chart marks multiple decent exit points as per the strategy:

Example Trade

This strategy triggered an entry in Trent Ltd. on 9th August 2024 when stock prices were trading near the 52-week high, daily volumes were more than 3 times the 1-day ago volume SMA, the daily RSI was above 65, and the daily close & open were greater than the previous day close & open, giving a buy signal. An exit was marked when the minimum target of 1:2 was achieved on 12th August 2024 (at 10:15 am). The trade yielded a return of 1.35%.

Don’t forget

- This strategy is best suited to be used in the 30-minute time frame for most stocks. However, for some stocks, a 15-minute time frame may produce better results. Finding the optimal time frame involves a trial-and-error approach and necessitates thorough backtesting.

- It is wise not to depend solely on this strategy for your entire portfolio.

- Above-average trading volumes on the day of entry and exit serve as strong confirmation signals.

Learn scalping with these courses

Intraday Trading Strategies

by Jyoti Budhia

Options Scalping Strategies

by Himanshu Arora

Options Scalping Strategy

by Sivakumar Jayachandran

Frequently Asked Questions

Can I carry out a BTST trade in all the stocks listed in this scanner?

This scanner lists high momentum stocks trading at above average volumes. It is just a starting point to shortlist contestants for BTST trading. It is prudent to look out for more confirming signals before considering it for trading.

How can I learn more about intraday trading?

You can learn intraday trading from experienced traders and highly rated instructors at Upsurge.club. We would highly recommend Jyoti Budhia’s Intraday Trading Strategies course.