How to use the Fibonacci EMA Crossover scanner?

This scanner filters out stocks that have shown greater momentum in recent periods when the 8-day EMA crosses above the 13-day and 21-day EMA and the 13-day EMA crosses above the 21-day EMA on a daily time frame.

Let’s first understand what an exponential moving average (EMA) is:

Exponential Moving Average (EMA)

An exponential moving average (EMA), is a weighted average of the closing prices of the last few trading sessions, with a higher weight given to the most recent sessions. For example, a 30-day moving average shows the average price of the last 30 trading sessions, where the weight given to the most recent sessions would be more than the weight given to older sessions. The triple EMA’s crossover helps in the clear identification of trends and reduces false signals.

This strategy is suitable for swing traders because when the 8-day EMA crosses above the 13&21-day EMA it indicates that the stock is gaining short-term momentum which helps the traders to capture the move within a shorter period.

We recommend using the following stock universe, indicators, and time frame for this strategy:

- Stock Universe: Nifty 500

- Indicators: Exponential Moving Average

- Time Frame: Daily

Let’s learn how to enter and exit a trade with this strategy.

Entry

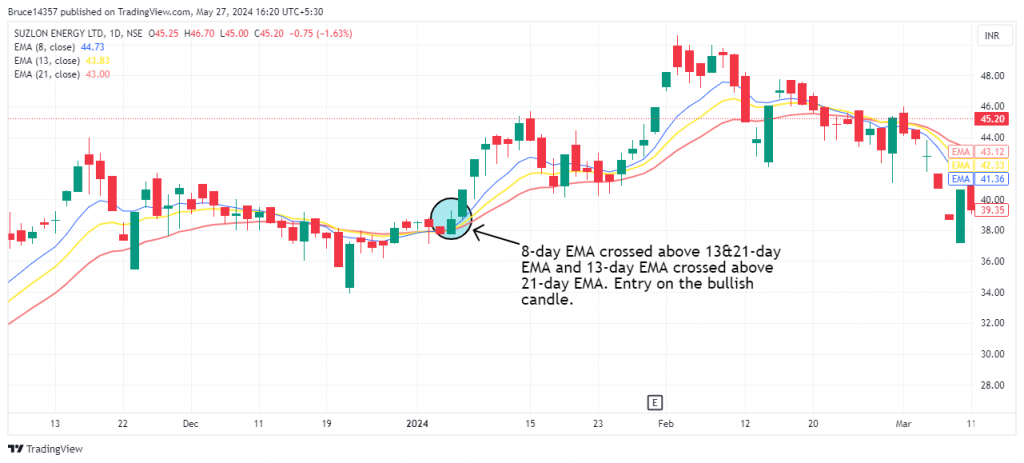

1. The scanner identifies stocks when the 8-day EMA crosses above the 13-day and 21-day EMA and the 13-day EMA crosses above the 21-day EMA on a daily time frame.

2. Enter the stock once this crossover is confirmed.

3. Ideally, you should enter the stock at the end of the day, on the first bullish candle after the crossover.

4. For a more risk-averse approach, consider entering the stock only when the bullish candle surpasses the high of the previous candle.

5. Spotting a bullish candlestick pattern like a bullish marubozu or morning star provides strong confirmation for entering the trade.

The following chart marks the ideal entry point after a triple EMA crossover occurs:

Stop Loss

The 13-day EMA acts as a stop loss for this trade. If the 8-day EMA crosses the 13-day EMA, it is a clear sign to exit, indicating that short-term traders are losing momentum.

Exit

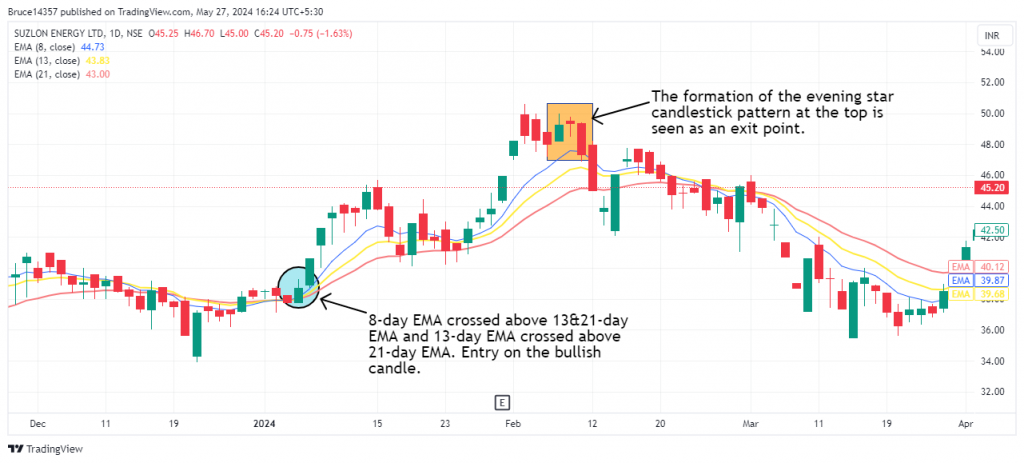

You can exit the trade in either of the following instances:

- The price reaches its latest swing high or previously tested resistance level.

- The 8-day EMA crosses below the 13-day EMA with a distinct bearish candle.

- Spotting a bearish candlestick pattern like a bearish marubozu, or evening star along with either of the above conditions provides strong confirmation for exiting the trade.

The following chart marks a good exit point as per the strategy:

Example Trade

This strategy triggered an entry in Suzlon Energy on 04th Jan 2024 when the triple EMA crossover occurred, and an exit was marked by an evening star formed at the top on 20th Jan 2024. The trade lasted 36 days, yielding a return of 31.4%.

Don’t forget

- This strategy is best suited to be used in the daily time frame for most stocks. However, for some stocks, a weekly or monthly time frame may produce better results. Finding the optimal time frame involves a trial-and-error approach and necessitates thorough backtesting.

- It is wise not to depend solely on this strategy for your entire portfolio.

- Above-average trading volumes on the day of entry and exit serve as strong confirmation signals.

Learn Trading with these courses

Technical Analysis in Hindi

by Jyoti Budhia

Basics of Momentum Trading

by Khagesh Agarwal

Fibonacci Trading Strategy

by Jyoti Budhia

Frequently Asked Questions

Can I use other Fibonacci number combinations for EMAs?

Yes, as long as the EMA numbers appear consecutively in the Fibonacci series, they can be used for EMA crossover strategies. Some of the examples are 21-34-55, 89-144-233, etc.

How else can I use Fiboncci levels in trading?

The Fibonacci series can be used in a number of ways in trading like Fibonacci number based EMAs, time zones, targets & stop loss setting, etc. Learn how to use Fibonacci levels in the best way possible for trading in Jyoti Budhia’s Fibonacci Trading Strategy course on Upsurge.club.